The Perth commercial property market continues it’s a significant contribution to the Western Australian economy.

Some background information could be useful when describing the Perth commercial property market 2023, particularly on the value composition between asset classes.

According to commercial property market analysis, the value composition breakdown of key asset classes in the Perth commercial property market based on 2021 figures are:

- Office space: Property values in the CBD are generally higher than the rest of the metropolitan area with values ranging from $5,000 to $10,000 per square metre.

- Warehouse and Industrial: Depending on factors such as size, location and facilities, values can range from $1,500 to $3,500 per square metre

- Retail Properties: High-end retail spaces command higher values, potentially exceeding $10,000 per square metre. Shopping malls have lower values, typically ranging from $3,000 to $7,000 per square metre.

With the overall sector experiencing record growth and hitting a peak in 2021 – 2022, how are the Perth commercial property market trends tracking in 2023?

Key Trends and Observations 2023

A summary of key trends and observations based on commercial property analysis for Perth as we head to the end of the year.

- The Perth commercial property market is showing a slump in 2023 following its peak in 2021 – 2022

- The cost of materials and global supply shortages, coupled with the ongoing challenge of labour shortages have resulted in the increasing demand for established properties.

- The Perth office market has experienced soft tenant demand, high vacancy rates, and weak rental growth in recent years still reeling from the Covid-19 fallout

- The industrial market has seen the strongest returns so far in 2023, bucking the trend

- The retail market has been impacted by the rise of e-commerce, resulting in a shift towards experiential retail.

- Ongoing interest rate rises are expected to lower commercial property valuations throughout much of 2023 at a national level

Factors Impacting the Commercial Property Market 2023

Office – Work from Home Trends

The post-pandemic work-from-home trend remains a challenge for the office asset class, with high vacancies particularly plaguing cities like Perth, showing capital returns -6.4%. Commercial landlords particularly in the Perth CBD have resorted to strong incentives to attract tenants, impacting effective rental rates.

Even though 67,479 square metres of office space entered the market, the Property Council of Australia’s July Office Market Report revealed that Perth’s office vacancy has been standing at an essentially unchanged 15.9%, with a minor 0.2% uptick since January 2023.

CBRE senior director of office leasing, Andrew Denny, is also optimistic about Perth’s office market remarking that “the negative effect of the work-from-home trend is minimal in the Perth market and is heavily outpaced by the dominant theme of expanding tenants.

“Moving forward, with sharply reduced vacancy rates in the suburban markets, we expect a growing number of tenants, especially larger space users, to relocate to the CBD from the suburbs.”

Migration levels increasing

Following diminishing overseas migration during the pandemic years, the government is looking to grow the population in major cities, including Perth. Increasing overseas migration, including international students, benefits the workforce for many industries, inducing a positive flow-on effect on commercial property.

While this only had a minimal impact on the commercial property market in 2023, the momentum will establish an uptrend for the following year.

Impact of Interest Rates

The official cash rate increased in February, March, May, and June. With the likelihood of at least one or two more rises this year, we are forecasting an uptrend in rental rates in both office and industrial assets with inner-suburban office markets outperforming.

As interest rates create a level of cautiousness in the market, investment properties have remained steady. It has somewhat been underpinned by the owner-occupier market. This is likely to consume any well-priced opportunities.

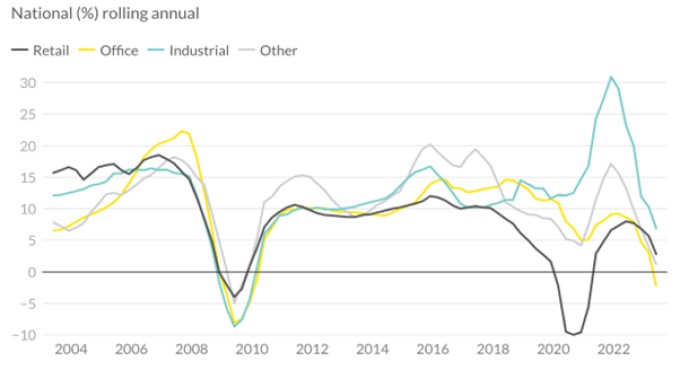

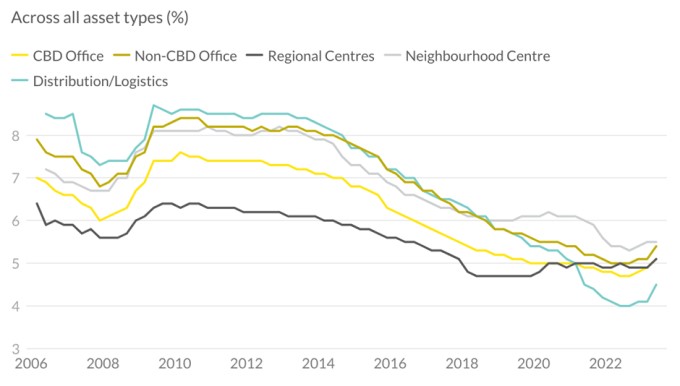

Data from MSCI suggests that while total returns across all major asset classes have slumped, total returns have stayed positive for most asset groups, these figures were shored up by robust income returns. Except for industrial, every asset type has seen its capital returns dip into negative territory.

Stability of income return

Total returns are in positive territory, while capital returns have fallen into negative for all asset types except for industrial due to the total returns of income returns.

This has created an exception for this particular asset class.

High demand for industrial stock

With the returns into positive territory, as stated earlier, industrial assets posted the lowest capitalisation rates at 4.5%, with the stock shortage and income stability associated with these assets continuing to entice investors.

Driven by high demand for industrial stock coupled with a nationwide supply shortage, this sector has been bucking the Perth commercial property market trends in 2023. Capital growth remained positive in most regions including Perth. This asset class remains the most sought-after, keeping yields averaging just 4.6%.

The demand for industrial assets is largely attributed to the rise of online retailing or e-commerce. However, according to Ray White’s head of research, Vanessa Ryder, “While this is a huge driver for the need for larger distribution facilities and our appetite to purchase items which see the growth in the storage and distribution of goods, we have also seen a strong increase in small business, which has resulted in strong absorption of industrial space,” she said.

“Also, our consumption is such that demand for groceries, including cold storage needs for fresh food, and pharmaceuticals, has increased. Coupling this with limited land availability around the country as well as a slowdown in new supply construction thanks to the high construction costs and labour shortages has seen vacancies remain historically low.”

Adding to our demand for goods, we have seen a greater need for smaller warehousing, and distribution facilities throughout the Perth metropolitan area catering for the last mile distribution of goods.”

Remaining Outlook for 2023:

According to commercial property market analysis, further cap growth across all asset types is anticipated regardless of interest rate movements. Over the short term, investment into commercial property and the risks associated will see buyers more considered. This is expected to keep upward pressure on investment yields.

Perth has been resilient compared to the national stage in the continuing challenges experienced by global economies. Commercial and industrial markets in Perth are in a good place with a strengthening office market and a reduced vacancy rate expected. Rental growth is strong, and investors are capitalising on what is expected to be a period of growth in the Perth commercial property market for 2023 and beyond.

How a property manager can help

Considering the present challenges and future opportunities ahead, an experienced commercial property management team with insight and knowledge will be best placed to assist in managing the intricacies of your commercial assets.

Vast Commercial Property are experts in the field who will provide personalised commercial property management services from legal and financial matters to tenant relations. We ensure your investment is not just managed but optimised for success!

Call the experts in commercial property management and set yourself up for success.